The Best Guide To Ach Processing

Table of ContentsThe Greatest Guide To Ach ProcessingThe smart Trick of Ach Processing That Nobody is DiscussingThe 10-Second Trick For Ach Processing4 Simple Techniques For Ach Processing

More just recently nonetheless, financial institutions have actually concerned allow same day ACH repayments or next-day ACH transfers that take only one to two business days. So as long as the electronic payments demand is sent prior to the cutoff for the day, it's possible for the cash to be obtained within 24-hour - ach processing.Whatever type of ACH settlements are entailed, a transfer is a procedure of 7 steps, which begins with the money in one account as well as finishes with the money getting here in another account. ACH payments begin when the begetter (payer)starts the process by requesting the purchase. The mastermind can be a customer, business, or a federal government agency.

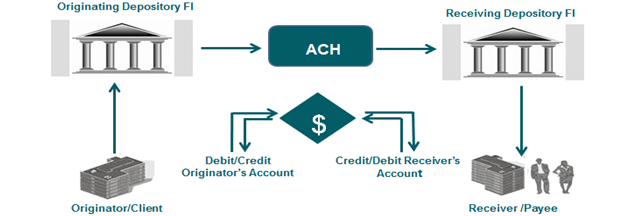

Once a transaction is launched, an entry is sent by the bank or payment cpu dealing with the very first stage of the ACH settlements process. The bank or payment processor is called the Originating Vault Financial Institution (ODFI). Banks usually send ACH access in sets, typically 3 times a day throughout normal company hours.

Reserve bank and the EPN are nationwide ACH drivers. Once gotten, an ACH driver types the set of entries right into down payments as well as settlements, as well as settlements are then arranged right into ACH credit report as well as debit settlements. This guarantees that money is moved in the appropriate direction. After arranging access, the ACH driver sends them to their destined financial institution or financial establishment, called a Receiving Vault Financial Institution (RDFI).

Ach Processing Fundamentals Explained

When receiving ACH repayments, the obtaining monetary organization either credit scores or debits the receiving bank account, depending on the nature of the purchase. While the total cost related to accepting ACH payments differs, ACH fees are usually more affordable than the fees connected with approving card repayments. One of the biggest cost-influencers of approving ACH settlements is the quantity of transactions your business plans to process.

When accessing ACH indirectly via a Third Party Repayment Cpu (TPPP), a number of kinds of charges might be involved: While both cord transfers (like SWIFT) as well as ACH repayments permit digital settlement of funds to financial institution accounts, the primary difference is that cable transfers are made use of to promote global settlements, whereas electronic ACH settlement is only available domestically. Whether you're an acquirer, payments processor or vendor, it's crucial to be able to gain full real-time exposure right into your settlements ecological community. Improperly doing systems boost frustration throughout the whole repayments chain. Bringing real-time visibility and settlement surveillance to your whole environment, Negotiate uncovers unmatched understandings right into ACH deals and settlements patterns to aid you simplify the settlements experience, turn data right into intelligence, and guarantee the repayments that keep you in service.

Things about Ach Processing

When you transfer cash to your good friend's account, ever wondered exactly how it functions? What really takes place behind the scenes? Possibilities are you have currently made use of ACH repayments, yet are not accustomed to the jargon. Several of the examples of ACH deals consist of: Online bill settlements via your checking account, Moving money from one financial institution account to another, Paying vendors or obtaining money from consumers through straight down payment, Straight deposit payroll to a worker's monitoring account utilized by business, Let's check out ACH settlement refining more in detail.

The ACH network of monetary organizations (financial institutions as well as credit report unions) assists in transactions in the USA as well as is managed by National Automated Cleaning House Organization (NACHA). According to NACHA, ACH payments daily went beyond 100 million in February 2019. The newest numbers from NACHA revealed a 7. 1% increase in ACH transaction volume for the very first quarter of 2020, with B2B settlements posting an 11.

You move money to a Silicon Valley Bank account from your Financial institution of America account. And a person does an inverse transaction also. Both the financial institutions need to credit as well as debit each various other's accounts. An instant credit/debit process for each and every transaction might seem quicker, yet has a great deal of underlying downsides.

ACH is view publisher site one such main clearing up system for banks in the United States. ach processing. Cord transfers are interbank digital payments. While wire transfers seem to be comparable to ACH transfers, below are some crucial distinctions between them: Can take a few service days, Instantaneous, Free for a receiver, nominal charges ($1) for a sender, Both the sender and receiver are billed charges.

The Buzz on Ach Processing

Can be challenged if problems are met, As soon as initiated, can not be canceled/disputed, No human treatment, Typically includes teller, Both send and also ask for payments. For settlement requests, you need to publish the ACH file to your bank. Just send repayments, Refined in batches, Processed real-time, A cord transfer is excellent for you when time is essential, while ACH processing is a much better alternative for non-mission-critical as well as repeating payments. Currently in any kind of transfer, 2 people are included.

Your consumer authorizes you to debit their checking account on his part for repeating deals. Allow's claim Jekyll needs to pay an amount of $100 to Hyde (think they're two different people) and chooses to make an electronic transfer. Here is a step by step break down of just how a financial go to my site institution transfer using ACH works.